National Corporate Identification (2022)

Introduction

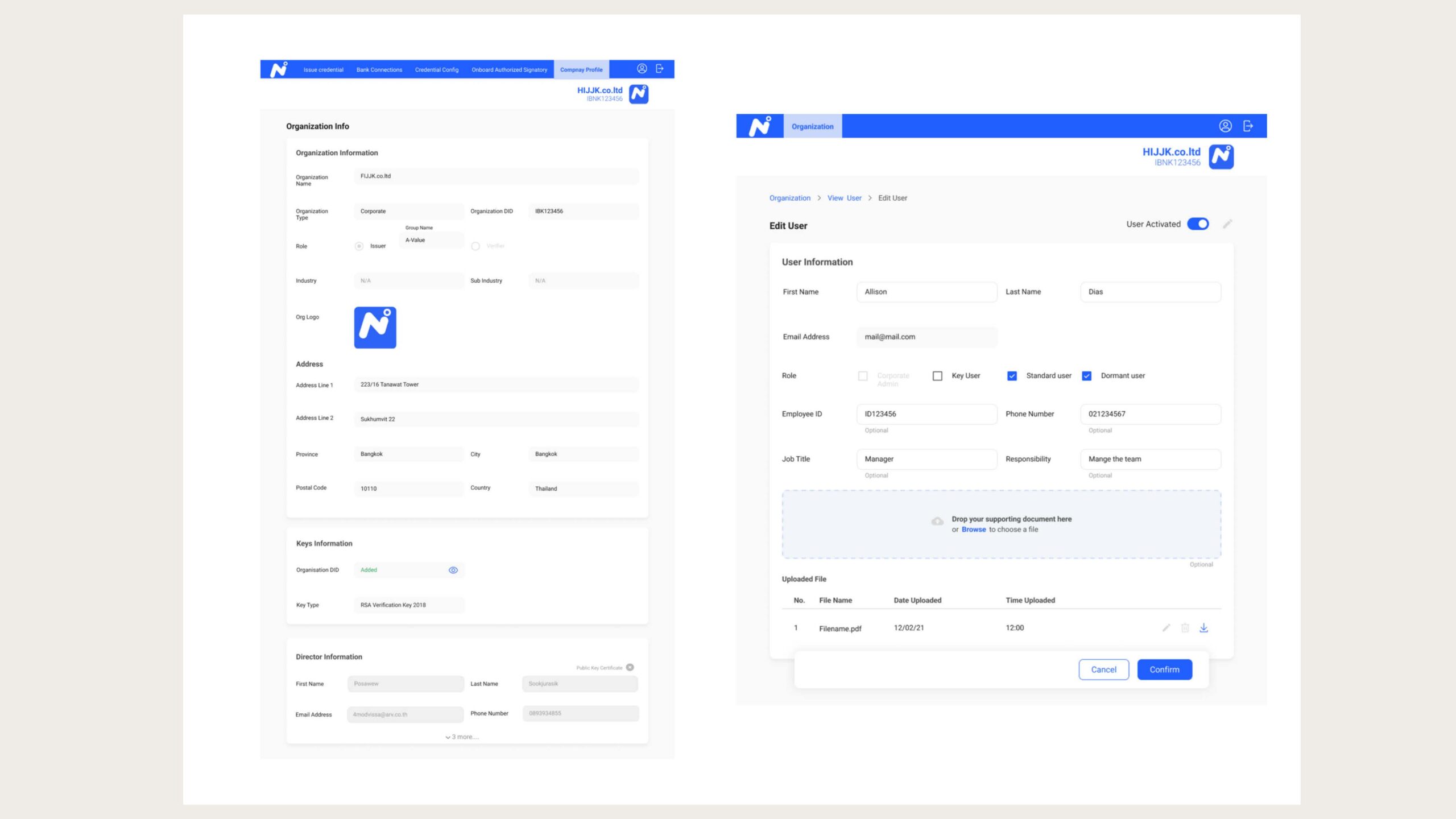

This project involved the development of a Corporate Banking Account Opening Management System, designed to streamline document handling for account opening applications and verify the identities of individuals involved in the process. The system was developed to comply with Thailand’s laws and regulations and features an interface designed for ease of use by banking staff and corporate customers.

Research & Analysis

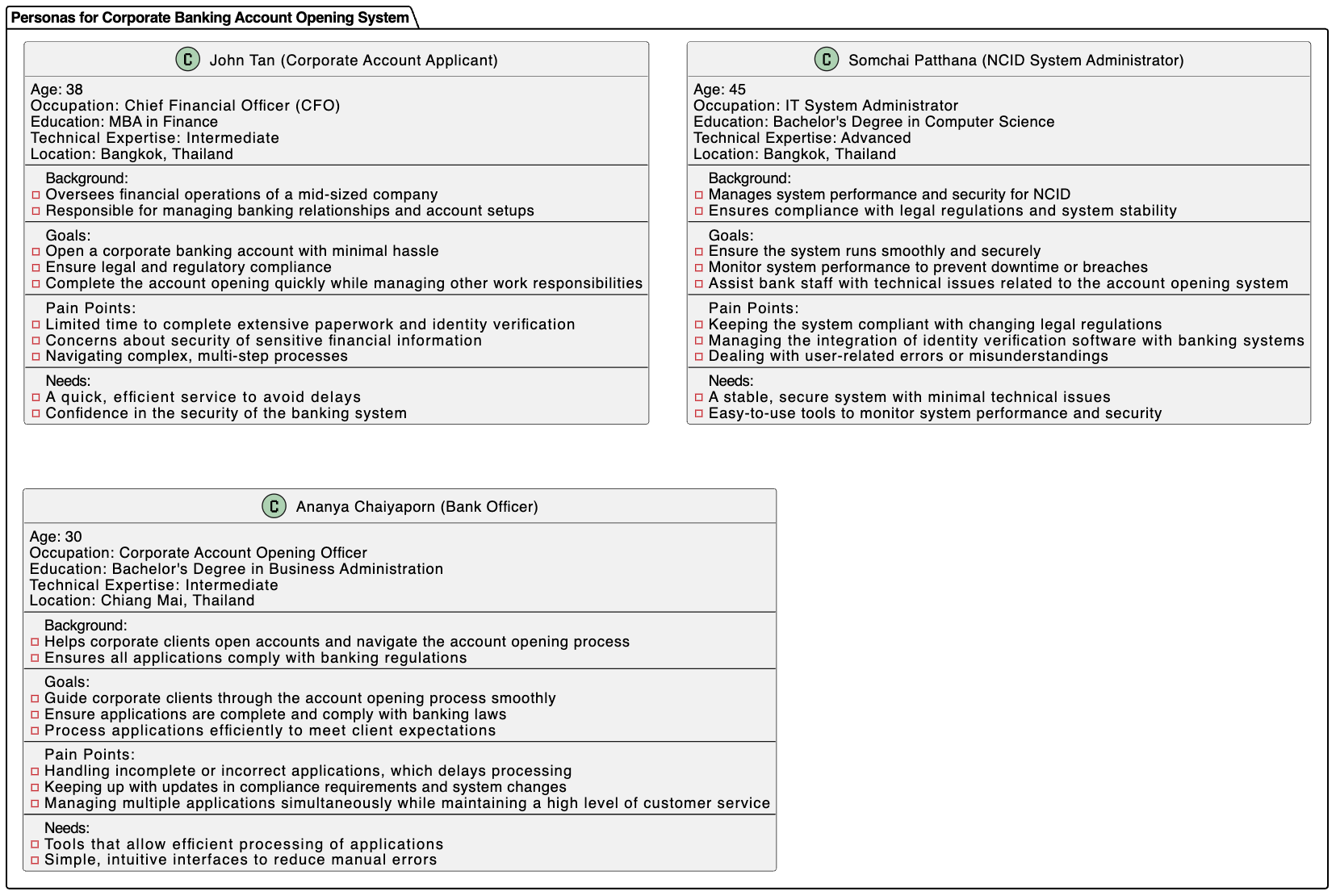

The process began with data collection to understand user needs, both from internal staff and external users. We conducted research and analysis to define pain points and identify key user requirements for the system.

System Design

You can view the workflow here: https://www.figma.com/board/0tlrETfm4qb5kfd6h1xNXp/Journey-Map?node-id=0-1&t=5YBpTSngwbMriMJG-1

The system was designed to ensure that users could easily navigate the document submission and identity verification process. The interface was tailored to provide clear instructions and reduce manual errors during the application process.

- Key Components:

- Document submission form

- Real-time identity verification

- Legal compliance checks

Development & Implementation

During the development phase, I collaborated closely with developers to ensure that the system’s architecture aligned with the initial design plans. I was also involved in consultations to ensure that the technical aspects complied with Thailand’s legal requirements regarding data privacy and financial transactions.

Testing & Feedback

The system underwent multiple rounds of testing, focusing on user experience (UX) and functionality. Feedback from both end-users and stakeholders was collected to refine the system and ensure that it met the operational needs of the bank.

Explanation:

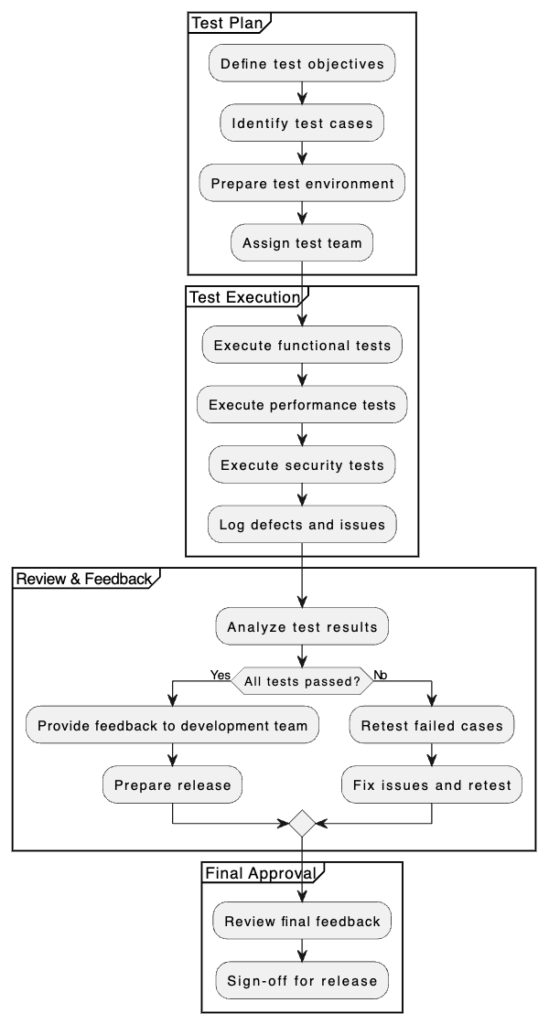

- Test Plan: The process starts with defining test objectives, identifying test cases, preparing the test environment, and assigning the test team.

- Test Execution: This involves executing functional, performance, and security tests while logging defects and issues.

- Review & Feedback: After analyzing the test results, the system is either passed on to the development team with feedback or retesting is done for failed cases.

- Final Approval: A final review of the system is done, and once all tests are passed, the system is approved for release.

Explanation:

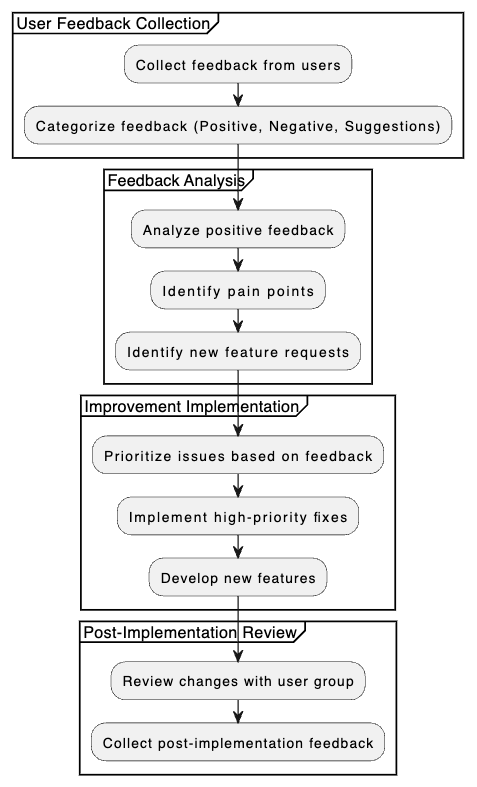

- User Feedback Collection: Feedback is gathered from users and categorized into positive, negative, and suggestions.

- Feedback Analysis: Positive feedback is analyzed, pain points are identified, and new feature requests are noted.

- Improvement Implementation: Issues are prioritized based on the feedback, high-priority fixes are implemented, and new features are developed.

- Post-Implementation Review: After improvements are made, changes are reviewed with the user group, and post-implementation feedback is collected.

Conclusion

This project successfully delivered a robust and user-friendly system that helps corporate clients and bank staff efficiently manage account opening processes while complying with legal requirements. The system has significantly reduced processing times and enhanced data security through its integrated verification features.