SMAP (2023)

Client: Kasikorn Bank

Role: UX/UI Designer

Project Overview

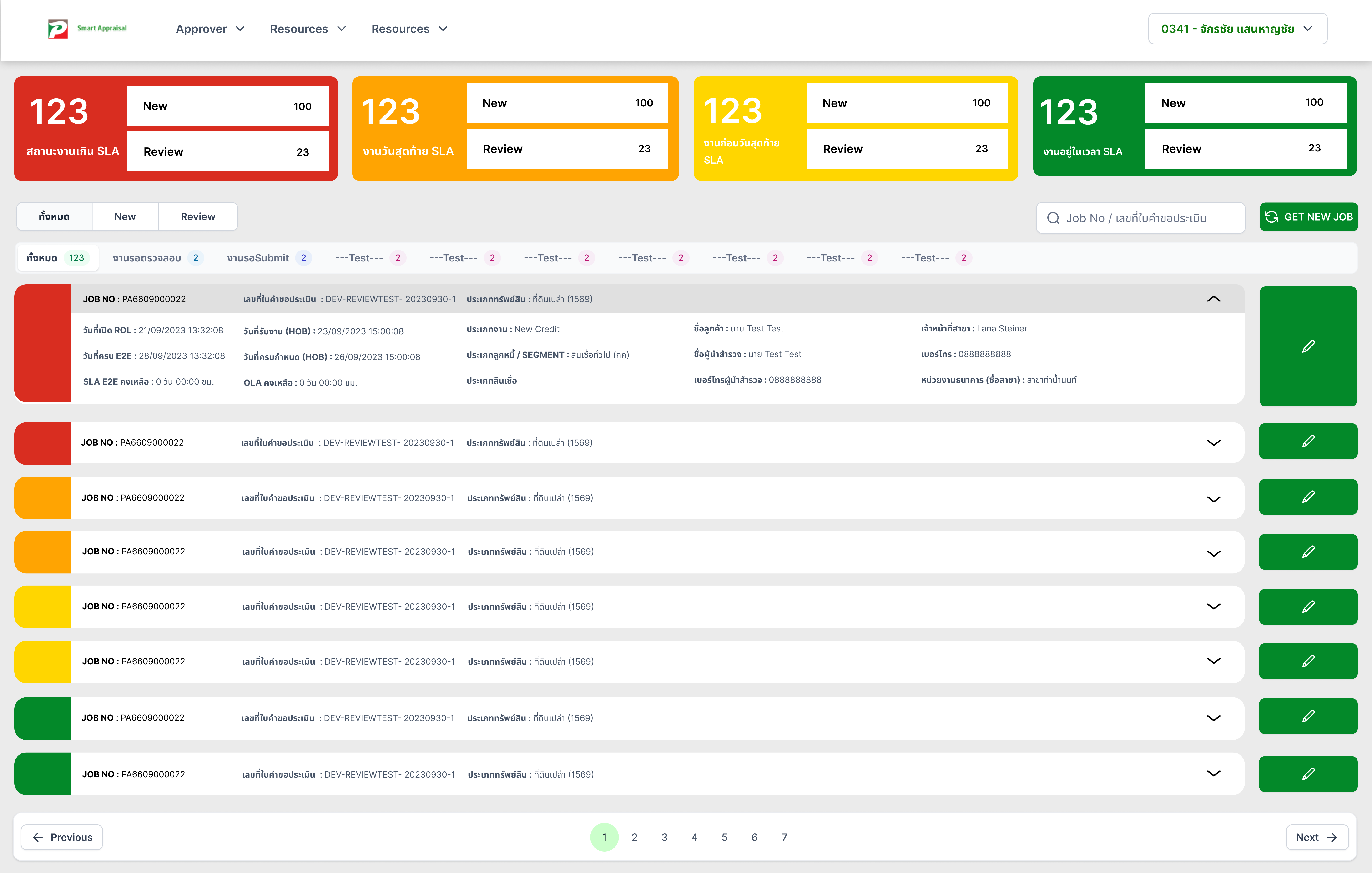

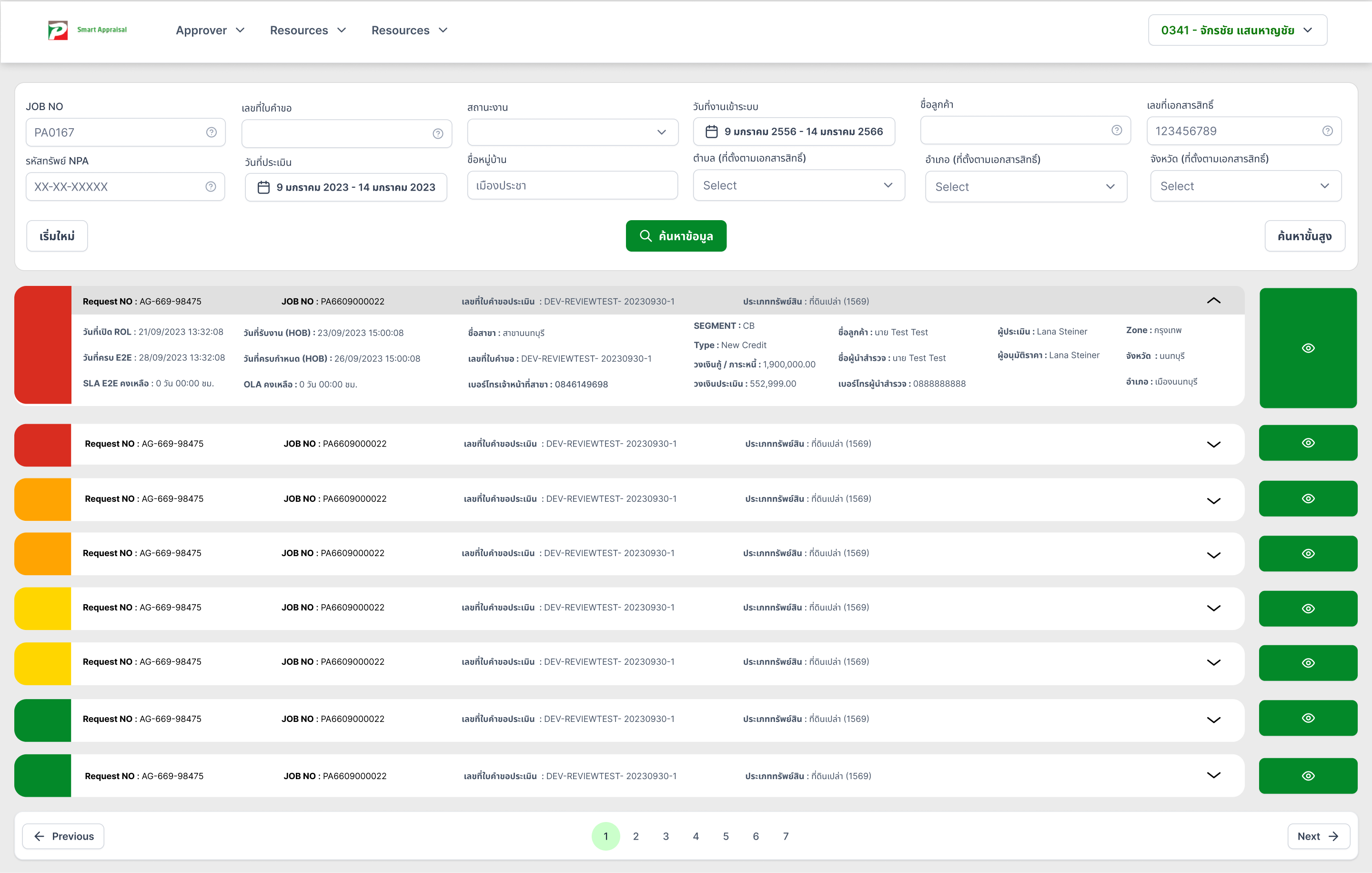

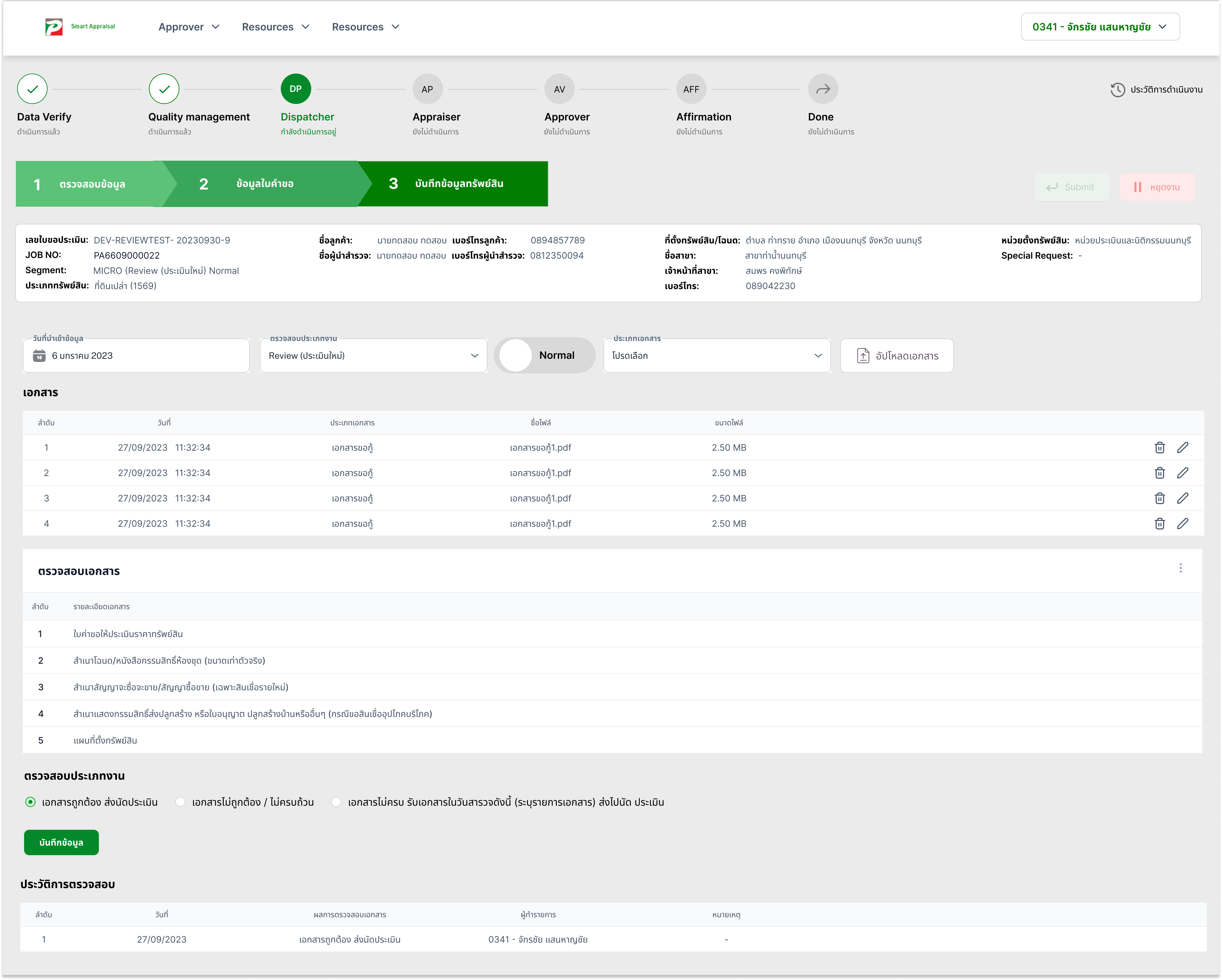

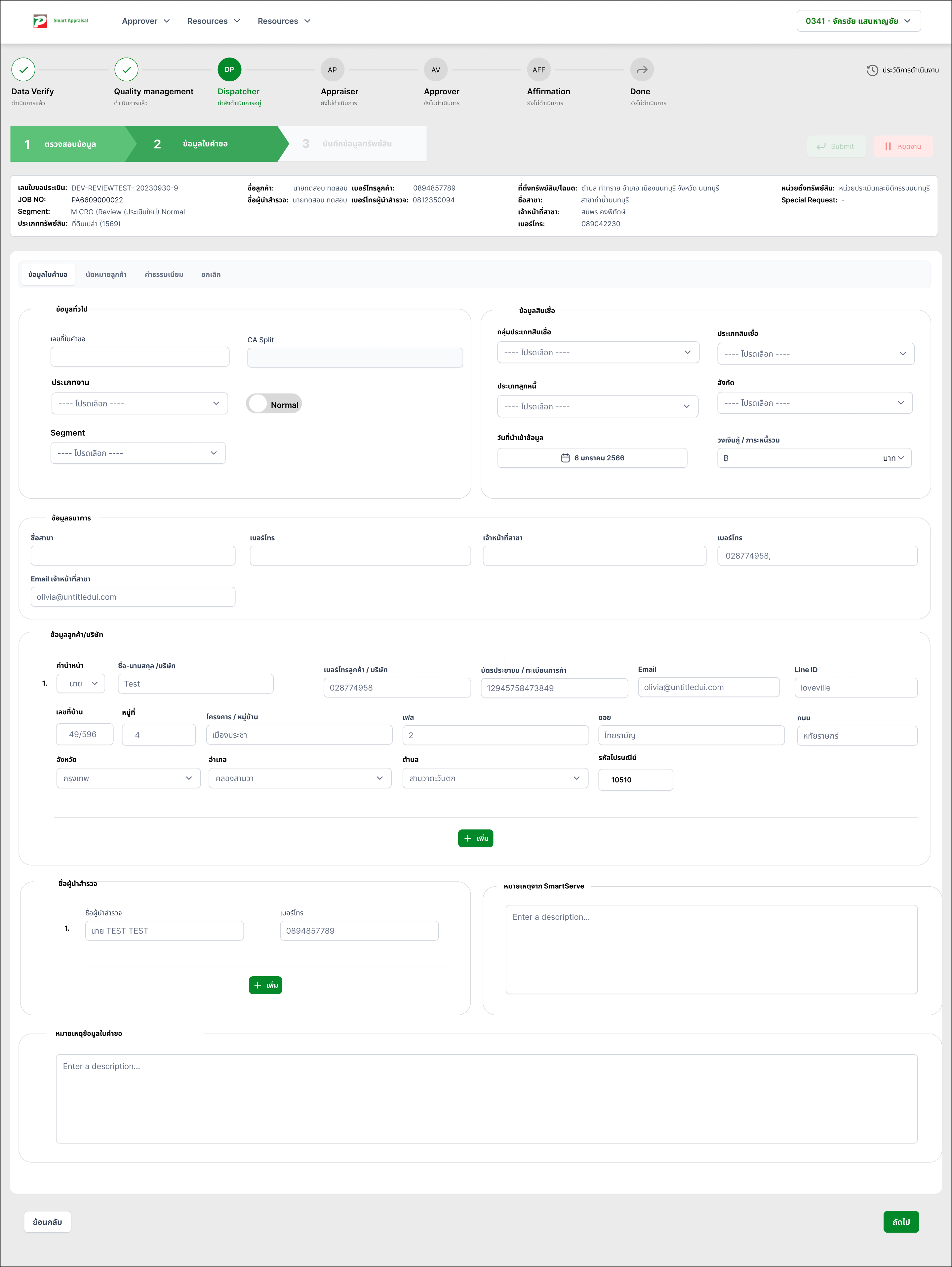

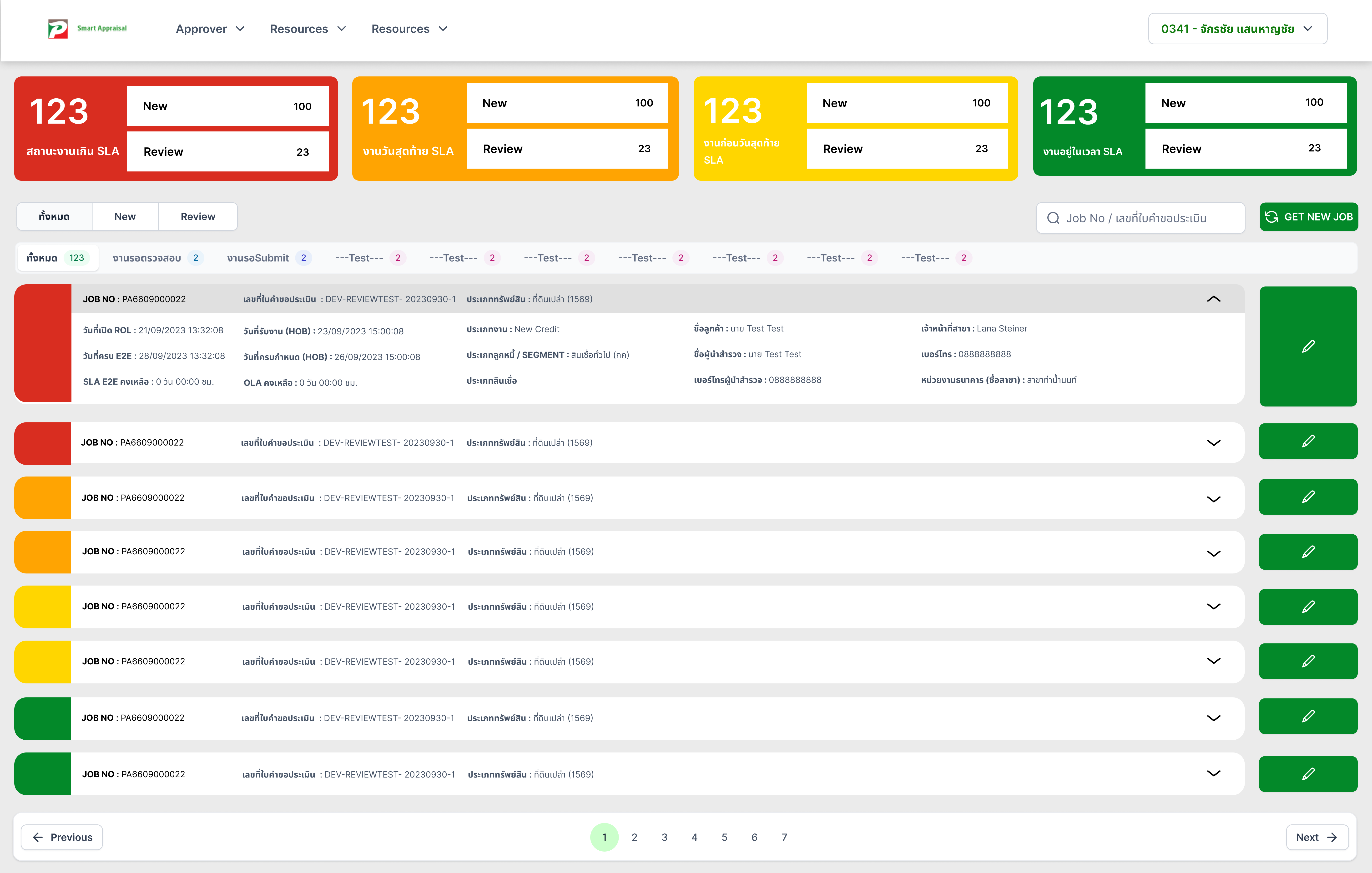

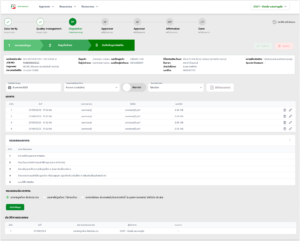

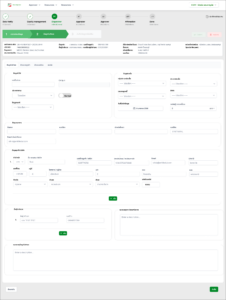

The SMAP system is a comprehensive real estate loan management platform designed for internal use by banks and appraisal companies. The goal of the project was to optimize the system’s interface for better operational efficiency and ease of use, particularly for employees managing complex real estate loan processes.

Problem Statement

The existing version of the SMAP system did not adequately meet the needs of its primary users—bank officers and real estate appraisers. The outdated interface and workflow design led to inefficiencies in their daily operations, resulting in frequent errors, increased task completion time, and frustration. The system’s inability to adapt to the evolving requirements of these users made a complete redesign necessary to enhance its usability, improve operational efficiency, and ensure alignment with current user workflows and expectations.

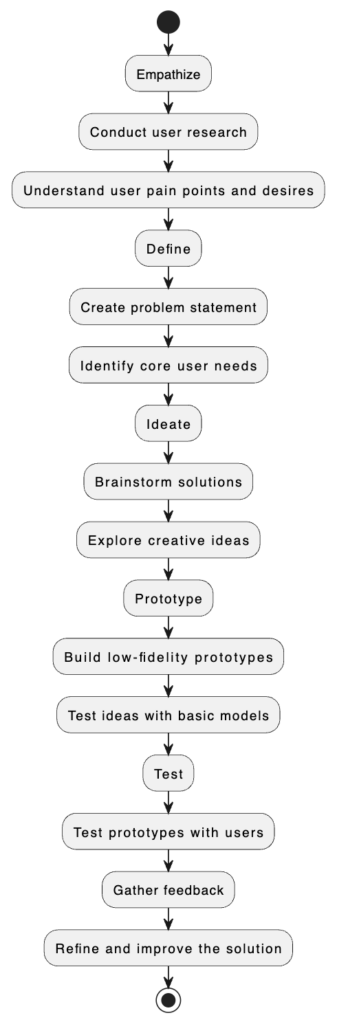

Design Thinking Process Stages

- Empathize

- Understand the users and their needs through research.

- Conduct interviews, surveys, and observations to gather insights on user pain points, behaviors, and desires.

- Goal: Develop a deep understanding of the user’s experiences and challenges.

- Define

- Clearly define the problem based on the insights gathered during the Empathize stage.

- Craft a problem statement that focuses on the user’s core issues and needs.

- Goal: Create a clear, user-centered problem that your team will solve.

- Ideate

- Brainstorm and generate a wide range of ideas for potential solutions.

- Encourage creativity, allowing for a variety of concepts to emerge without judgment.

- Goal: Explore different approaches to solving the problem and come up with innovative solutions.

- Prototype

- Build simple, low-cost versions of the ideas or features to explore how they might work in practice.

- Focus on speed and testing the feasibility of solutions rather than creating polished products.

- Goal: Create a tangible representation of ideas that can be tested with users.

- Test

- Test the prototypes with actual users to gather feedback.

- Learn what works and what doesn’t by observing how users interact with the prototype.

- Refine or rethink the solution based on user feedback and iterate as needed.

- Goal: Validate the solution and make improvements based on user feedback before moving to a final product.

My Responsibilities

- Data Collection for Operational Management: I conducted in-depth research and collected data on user workflows to understand current system inefficiencies. This allowed me to propose and design improvements that aligned with the operational needs of the users.

- UX/UI Design: Based on the findings, I redesigned the system interface, focusing on intuitive user operations and simplifying navigation across complex functionalities. The updated design aimed to reduce task completion times and enhance the overall user experience for internal stakeholders.

- Development Team Management: I worked closely with the development team to ensure that the system’s design was implemented effectively. This involved frequent consultations to align on design requirements, addressing technical constraints, and conducting reviews to maintain the design integrity throughout the development process.

- System Development Consulting: I provided strategic consultation on the planning of future system developments. This involved outlining key UX/UI priorities and creating a roadmap for iterative improvements that would continue to drive user satisfaction and efficiency.

Process & Approach

- Research and Data Collection

- Conducted interviews and user research with bank officers and real estate appraisers to gather insights on their workflows, pain points, and key needs from the system.

- Performed a heuristic analysis of the existing system to identify usability issues and inefficiencies.

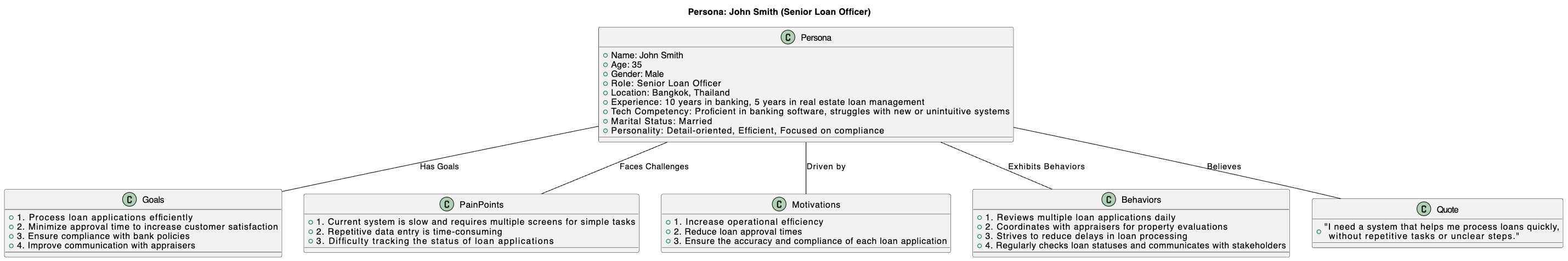

- Persona Development

- Created detailed personas based on the research data to represent the primary user groups.

- Each persona outlined user goals, frustrations, and key tasks in the system.

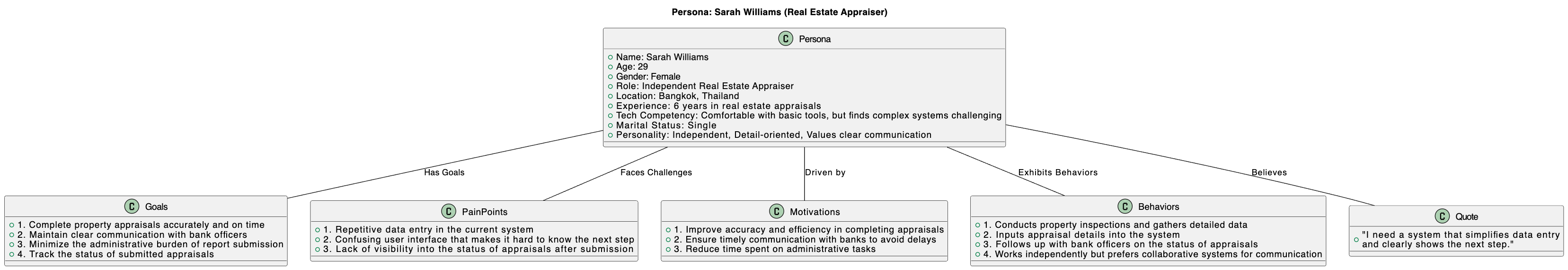

- User Journey Mapping

- Developed user journey maps to visualize the end-to-end experiences of bank officers and appraisers using the system.

- Identified key touchpoints, challenges, and opportunities for improvement at each stage of the journey.

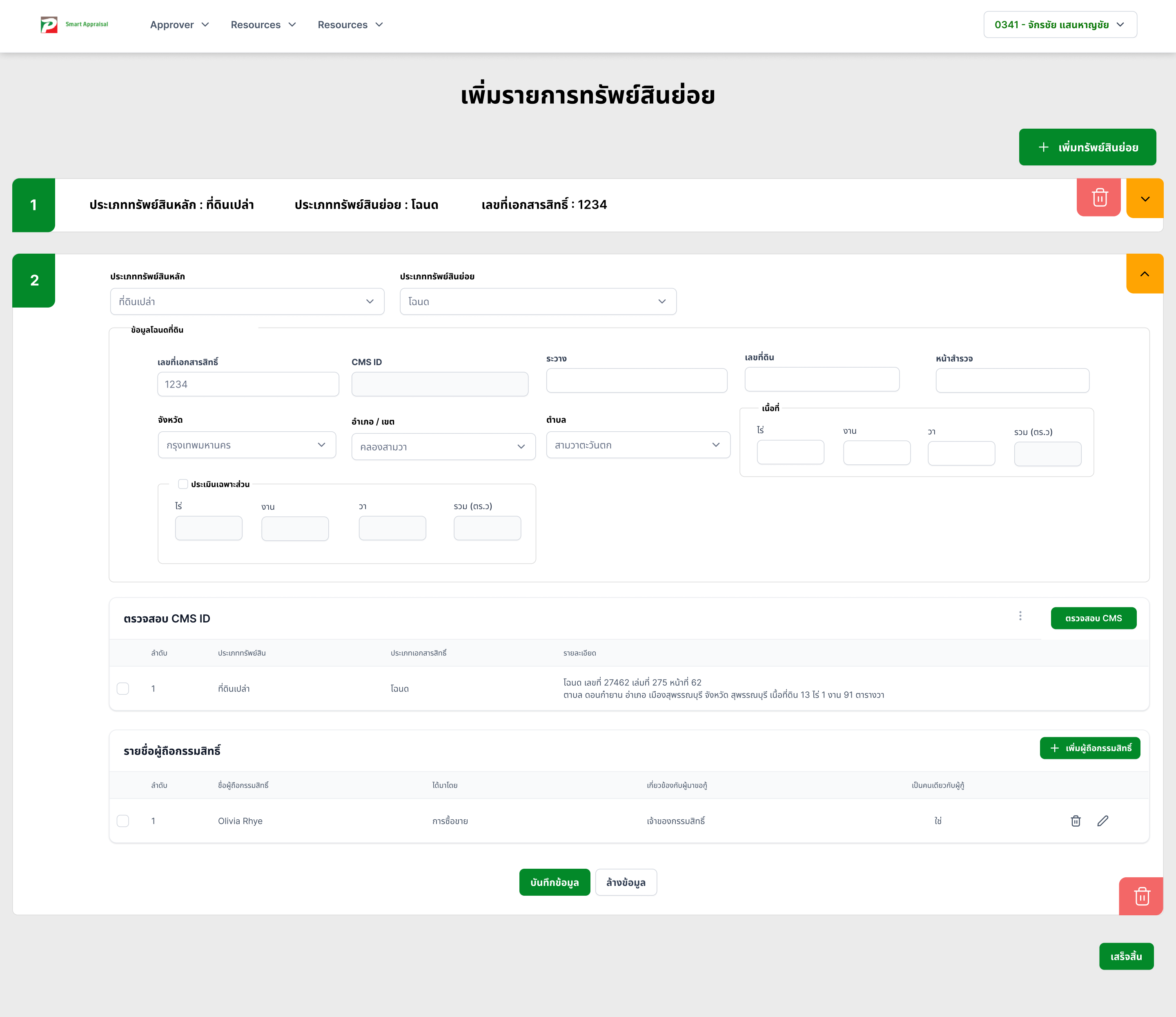

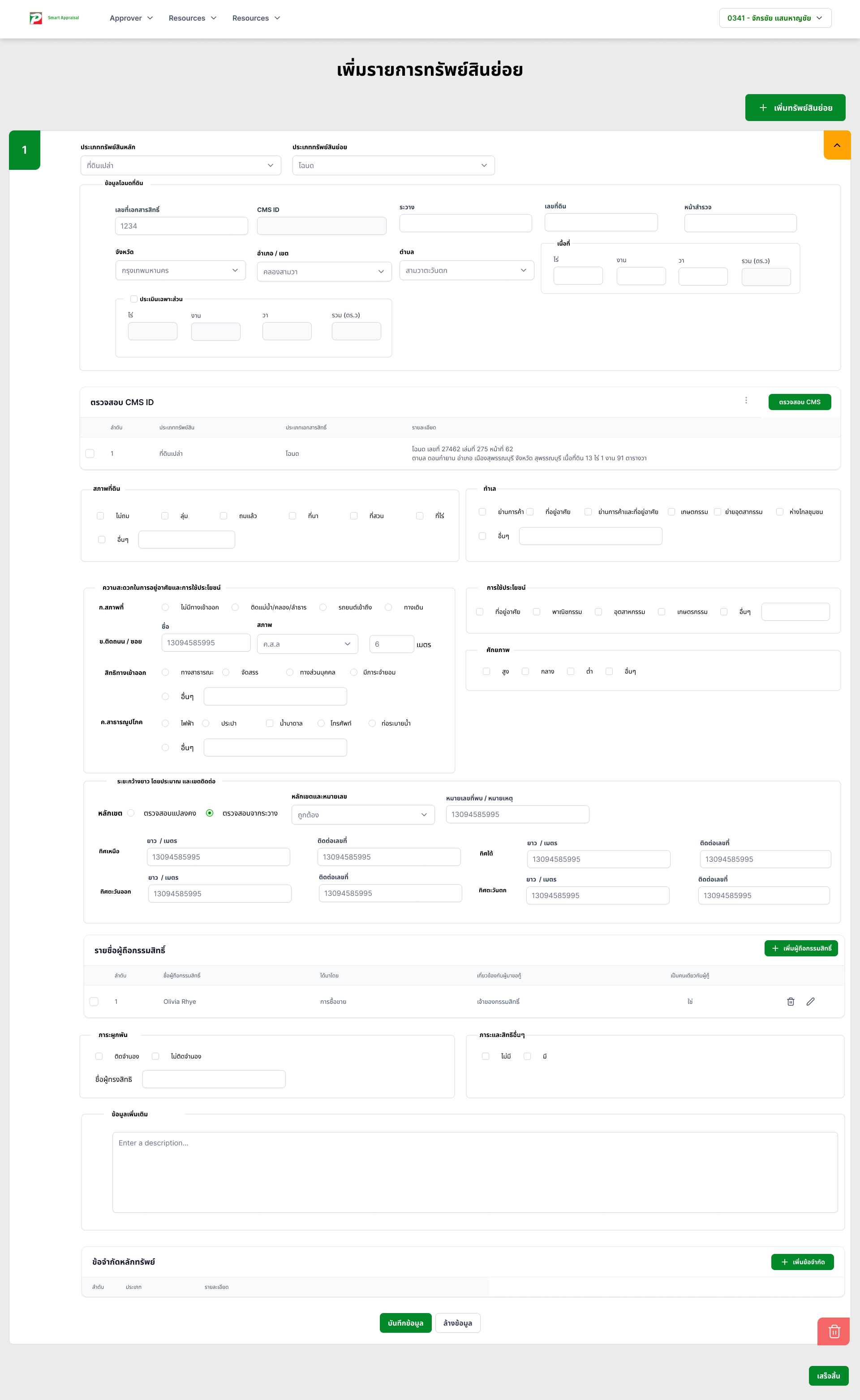

- Wireframes and Prototyping

- Designed low-fidelity wireframes based on the persona and journey insights to address identified pain points.

- Created interactive prototypes for usability testing with target users, refining the design iteratively.

- User Testing and Feedback

- Conducted user testing sessions with bank officers and appraisers to gather feedback on the prototypes.

- Made iterative improvements based on user input to ensure the final design addressed real user needs and optimized their workflow.

- Development Collaboration

- Worked closely with the development team to ensure the design was implemented correctly, adjusting the design where needed based on technical feasibility.

Persona

*The user cannot reveal their identity due to business reasons, thus requiring the creation of a fictional persona as a substitute for their basic profile.

Real Estate Loan Process Journey

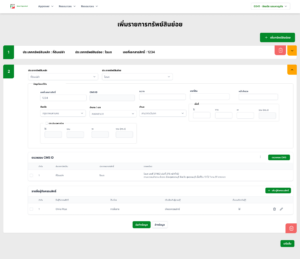

1. Loan Application Submission

- User: Bank Officer / Customer

- Action:

- The customer submits a loan application for a real estate purchase to the bank.

- The bank officer receives the application and enters the necessary data into the SMAP system.

- Pain Points:

- Bank officer may need to input repetitive information.

- The current system requires multiple steps to finalize the application submission.

- Improvement Opportunity: Simplified, single-entry process for data with auto-fill options.

2. Initial Application Review

- User: Bank Officer

- Action:

- The bank officer reviews the loan application details (applicant’s financial data, property details, etc.) to ensure completeness.

- If any documents are missing, the officer communicates with the customer for more information.

- Pain Points:

- Difficulty tracking missing documents or following up with customers.

- Slow navigation between sections in the current system.

- Improvement Opportunity: Clear document tracking and a task-based dashboard for follow-ups.

3. Property Appraisal Request

- User: Bank Officer / Real Estate Appraiser

- Action:

- The bank officer requests an appraisal from a real estate appraiser to evaluate the property’s value.

- The request is sent through the SMAP system, and the appraiser receives a notification.

- Pain Points:

- Lack of visibility into the appraisal request status.

- Confusing steps to track appraisal requests.

- Improvement Opportunity: Real-time tracking of appraisal status with reminders for pending actions.

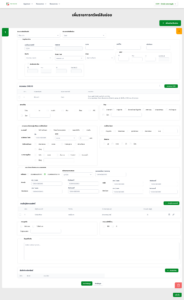

4. Property Inspection and Data Collection

- User: Real Estate Appraiser

- Action:

- The appraiser inspects the property and gathers necessary data (photos, property details, etc.).

- Data is entered into the SMAP system and the appraisal report is prepared.

- Pain Points:

- Repetitive data entry during the inspection process.

- Unclear next steps after data collection.

- Improvement Opportunity: A streamlined, guided data entry interface for appraisers, ensuring no missing data and clear visibility of the next action.

5. Appraisal Report Submission

- User: Real Estate Appraiser

- Action:

- The appraiser submits the final appraisal report to the bank through the SMAP system.

- The bank officer receives a notification that the report has been submitted.

- Pain Points:

- Lack of visibility into report submission status for the appraiser.

- Bank officer may need to manually follow up on the appraisal report if not notified in time.

- Improvement Opportunity: Immediate notifications upon submission and a transparent status bar indicating report progress for both bank officers and appraisers.

6. Final Loan Approval Decision

- User: Bank Officer

- Action:

- The bank officer reviews the completed loan application, along with the appraisal report.

- A decision is made based on the property value, financial data, and other loan criteria.

- The decision (approval or rejection) is communicated to the customer.

- Pain Points:

- Difficulty in consolidating information from different sections of the system.

- Repetitive steps to finalize the loan decision.

- Improvement Opportunity: A consolidated decision-making dashboard, providing all necessary information on a single screen.

7. Loan Disbursement or Rejection

- User: Bank Officer / Customer

- Action:

- If the loan is approved, the bank initiates the loan disbursement process and the customer is informed.

- If the loan is rejected, the customer is informed of the reasons, and the file is closed.

- Pain Points:

- The current system doesn’t offer clear follow-up workflows for rejected applications.

- Improvement Opportunity: Automated rejection workflows with communication templates and follow-up tasks.

Key Touchpoints in the Journey:

- Loan Application Submission: Streamlined application form and automatic data entry reduce the workload for bank officers.

- Property Appraisal Request and Review: Real-time tracking for both bank officers and appraisers ensures transparency in the appraisal process.

- Loan Decision Dashboard: A unified view that compiles all necessary data (application, financial status, property appraisal) in one place for faster decision-making.

- Feedback and Communication: Improved communication tools within the SMAP system to allow bank officers and appraisers to follow up on pending tasks or missing information easily.

Pain Points Addressed by SMAP:

- Repetitive Data Entry: Automated processes reduce manual entry and the risk of errors.

- Status Visibility: Clear, real-time status updates for both loan processing and property appraisals ensure that users are always aware of the next steps.

- Complex Navigation: A simplified and intuitive interface improves navigation and reduces the number of screens users need to interact with.

- Task Follow-up: Automated reminders and follow-up workflows for pending or rejected applications enhance user efficiency.

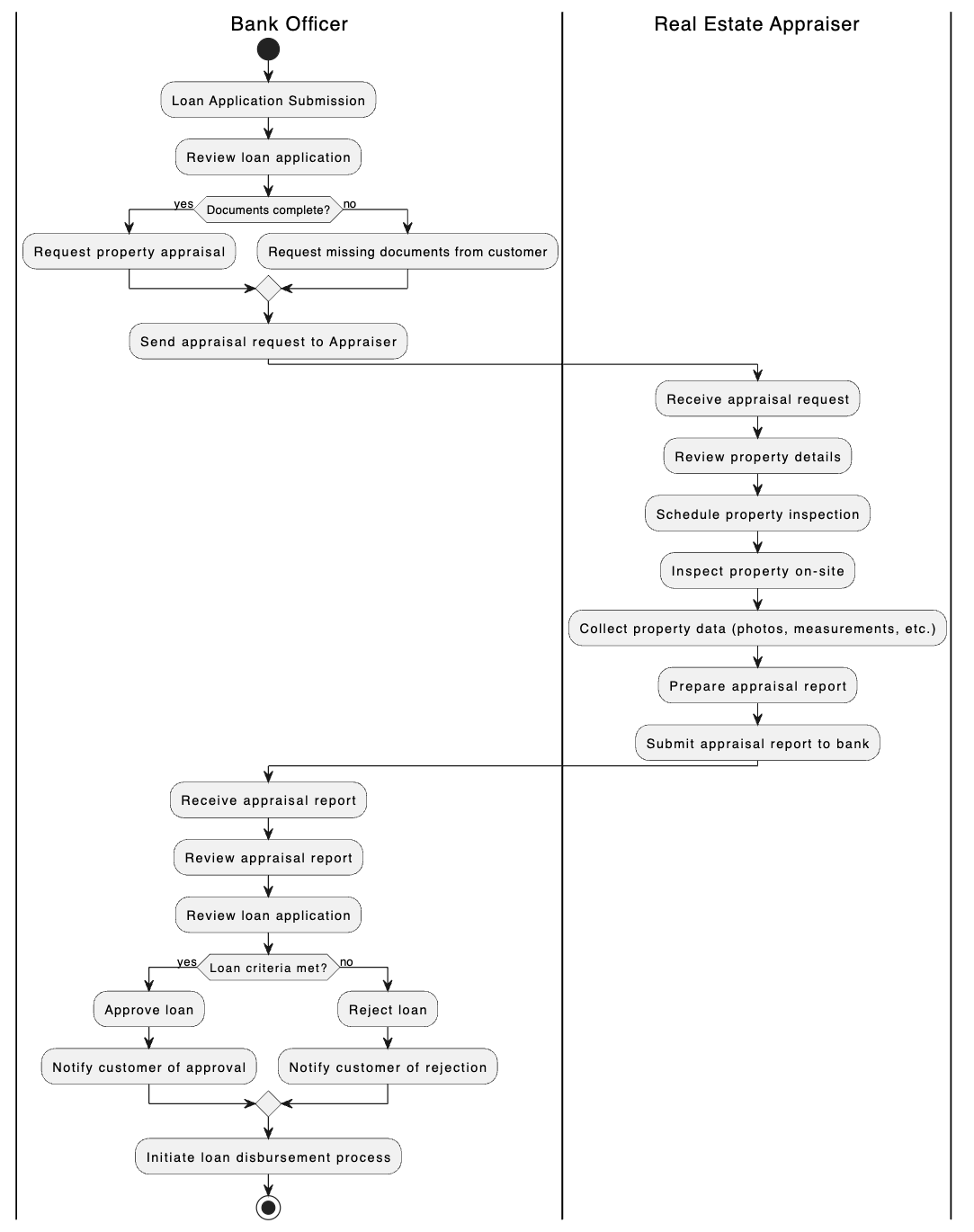

Real Estate Loan Process Journey for the Customer

1. Loan Research and Pre-Application

- User Action:

- The customer researches various loan options, compares rates, and gathers required documents (financial statements, property details, etc.).

- Pain Points:

- Confusion over which documents are required.

- Difficulty in understanding different loan terms and conditions.

- Improvement Opportunity: An easy-to-navigate loan information portal with clear guidelines for required documents and loan options.

2. Loan Application Submission

- User Action:

- The customer submits the loan application through the bank’s website or in-person.

- Uploads necessary documents (income proof, property details, ID, etc.).

- Pain Points:

- The submission process might require repetitive manual data entry.

- Unclear progress indicators about the application status.

- Improvement Opportunity: A streamlined online form with real-time document status and confirmation of successful submission.

3. Waiting for Loan Review and Property Appraisal

- User Action:

- The customer waits while the bank reviews the loan application and requests a property appraisal.

- Pain Points:

- Lack of transparency or updates during the waiting period.

- Anxiety due to uncertainty about the next steps or delays.

- Improvement Opportunity: Real-time status updates via email/SMS to keep the customer informed during the review and appraisal stages.

4. Appraisal and Further Document Requests

- User Action:

- The customer may receive additional requests from the bank for more documents (clarification of income, property details, etc.).

- Waits for the property appraisal to be completed.

- Pain Points:

- Need to provide additional documents unexpectedly.

- Delay in the appraisal process without clear communication.

- Improvement Opportunity: Clear messaging about why additional documents are needed and estimated timelines for the appraisal.

5. Final Loan Decision

- User Action:

- The customer receives a notification from the bank with the final decision: loan approval or rejection.

- If approved, the customer receives instructions on the next steps to finalize the loan agreement and disbursement.

- If rejected, the customer receives reasons for the rejection and possible next steps (reapplying, providing additional documents, etc.).

- Pain Points:

- Unclear reasoning if the loan is rejected.

- Improvement Opportunity: Provide personalized feedback for rejections and offer alternative loan options or corrective actions.

6. Loan Agreement and Disbursement

- User Action:

- If approved, the customer signs the loan agreement, either in person or online.

- The loan is disbursed to the relevant parties (seller, property developer, etc.), and the customer receives the funds.

- Pain Points:

- Paperwork for signing might be cumbersome and time-consuming.

- Improvement Opportunity: Offer digital signing options and a clear timeline for disbursement.

Key Improvements Highlighted:

- Real-Time Status Updates: Keeping the customer informed through every step of the process, especially during long waiting periods like appraisal and document review.

- Streamlined Document Submission: Reducing the repetitive nature of manual data entry and making it clear which documents are required upfront.

- Clear Communication for Rejections: Providing detailed feedback when loans are rejected, along with alternative solutions or corrective actions.

Design System

*The organization has chosen to adopt the untitled Design System for use in their work.

Design Overview

Conclusion for the Real Estate Loan Management System Project

This project focused on redesigning the SMAP real estate loan management system for Kasikorn Bank, with the goal of improving the user experience for both bank officers and real estate appraisers. The current system struggled to meet the evolving needs of users, leading to inefficiencies, errors, and frustrations in daily operations. By applying a user-centered approach, the redesign aimed to address these challenges and align the system with the users’ workflows.

Through the integration of Design Thinking, we deeply empathized with the users, defined the core problems, and iterated solutions based on real user feedback. Key improvements included streamlining data entry, enhancing transparency during the loan and appraisal processes, and improving the interface’s usability. The project’s collaborative efforts ensured that both user groups—bank officers and appraisers—benefited from increased efficiency, reduced task complexity, and better communication tools.

The final product significantly improved operational workflows, reduced loan processing times, and ensured a more seamless experience for internal users, ultimately contributing to higher user satisfaction and greater alignment with business goals. This project exemplifies how thoughtful design can transform complex systems into intuitive, user-friendly platforms that drive both efficiency and user satisfaction.